Over the last decade, consumer finance has gone through a dramatic evolution. What started as a simple idea — allowing shoppers to split purchases into easy installments — has grown into a global financing ecosystem that touches everything from e-commerce to healthcare. Buy Now, Pay Later (BNPL) has become an everyday financial tool, especially for younger generations looking for alternatives to traditional credit cards. But as BNPL matures, something new and rather unexpected is entering the scene: auction-based credit dynamics.

This next wave of innovation blurs the lines between pricing algorithms, risk scoring, alternative data, and real-time lending. It’s not just about letting consumers pay later — it’s about letting markets decide the cost and structure of that credit on the fly. And as flexible credit models evolve, the ecosystem around credit reporting, repayment behavior, and dispute resolution also grows more complex. Many consumers are already learning how to navigate new systems, whether through monitoring their credit or resolving old items placed by a Leafy Financial LLC collection agency entry or other third-party collectors.

In this post, we’ll explore a future where BNPL blends with dynamic auction pricing — and why this hybrid approach may redefine consumer lending over the next five years.

The Rise of BNPL: More Than Just a Payment Plan

BNPL became mainstream because it solves a simple emotional problem: people want things now, but they want to feel financially safe while getting them. With interest-free periods, transparent schedules, and minimal bureaucracy, BNPL offered an experience that old-school credit cards never managed to provide.

But behind the scenes, the economics were always more complex. Lenders must price risk accurately, merchants must evaluate payout timelines, and consumers expect fairness even when their financial situation changes. As the BNPL market matured, pressure grew on providers to innovate, improve scoring algorithms, and differentiate themselves in a crowded field.

And that’s where auctions come in.

Where Auctions Meet Credit

Imagine this: instead of a flat BNPL plan, you’re offered flexible installment terms that fluctuate based on market demand, your scoring profile, your purchase category, and even the time of day. Behind the interface, multiple lenders — or automated credit pools — “bid” for your transaction in milliseconds. Whoever offers the best combination of repayment schedule, interest (if any), and risk tolerance wins the deal.

This isn’t fantasy. Quietly, several fintech innovators, especially in Asia and the EU, are experimenting with AUCL models (Auction-Underwritten Consumer Lending). It combines the personal convenience of BNPL with dynamic market efficiency. Essentially, your repayment plan becomes a product inside a micro-auction.

Why does this matter? Because auctions can:

- reduce pricing inefficiencies, making credit more accessible;

- allow multiple lenders to compete for individual consumers;

- enable tailored offers based on real-time risk appetite;

- increase transparency around credit cost formation.

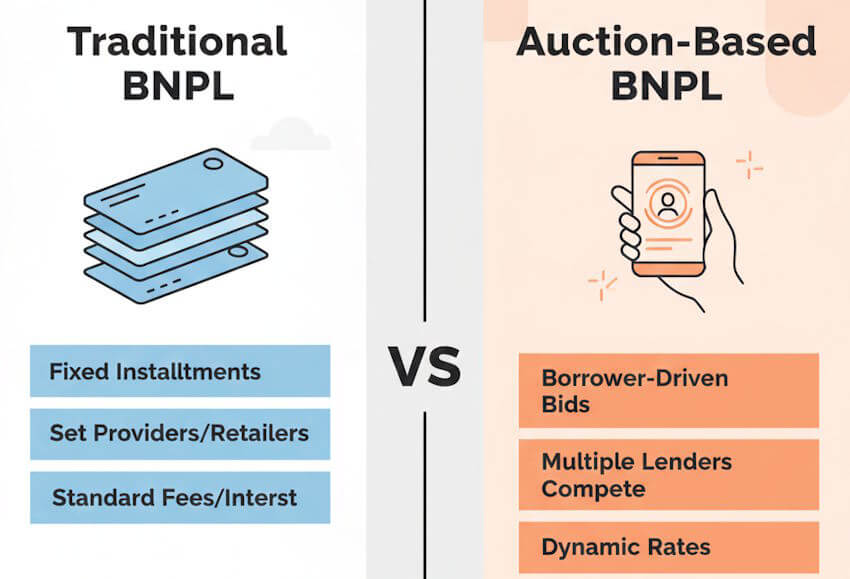

To understand how this works in practice, let’s compare traditional BNPL with auction-based models:

| Feature | Traditional BNPL | Auction-Based BNPL |

|---|---|---|

| Pricing | Fixed or preset by the provider | Determined dynamically through lender bidding |

| Risk assessment | Single provider evaluates risk | Multiple participants run micro-risk models simultaneously |

| User experience | Predictable but limited | Highly personalized repayment options |

| Market efficiency | Moderate | High — pricing reflects real-time market conditions |

| Scalability | Provider-dependent | Network-dependent; grows exponentially with participants |

Why This Hybrid Model Is Likely the Future

Consumers today expect personalization in almost everything — from streaming recommendations to workout plans. So why should credit still feel like a static, one-size-fits-all system?

Auction-driven BNPL offers personalization without sacrificing profitability. Lenders get more precise control over risk. Consumers get plans tailored to their current behavior, not outdated metrics. And merchants benefit from increased conversions as more buyers are approved under competitive pricing structures.

At scale, this could reshape the entire credit landscape:

- Credit becomes fluid, not fixed.

- Risk scoring updates in real time instead of monthly.

- Consumers gain more control over how they borrow.

- Lenders operate in a more transparent, competitive environment.

This doesn’t eliminate risk — it simply distributes it more efficiently across a broader ecosystem. However, with more lenders involved, questions about dispute handling, reporting accuracy, and consumer protection will grow as well.

The New Challenges: Reporting, Defaults & Transparency

As BNPL merges with auction systems, the nature of debt itself becomes more dynamic. This raises important questions:

- Who reports late payments — the winning bidder or the facilitator?

- How are disputes handled when multiple lenders are involved?

- What happens if a consumer refinances a plan mid-cycle?

- How do credit bureaus categorize auction-priced loans?

The industry will have to establish new standards for:

- data ownership,

- inter-lender communication,

- consumer transparency,

- and dispute resolution frameworks.

This is especially important as more consumers become financially aware and actively monitor their credit profiles to prevent errors or incorrect third-party reporting. The smoother the system, the fewer instances of unexpected entries or collection placements. By contrast, poor integration might create confusion, making it harder for consumers to understand where a debt originated and who is responsible for handling it.

Will Consumers Accept Auction-Based Credit?

Surprisingly, yes — as long as it feels intuitive. Most people don’t want to see complicated financial mechanics; they just want better outcomes. If the interface shows something like:

“We found 3 flexible plans for you — choose the one you prefer”

…then the auction can run quietly in the background without overwhelming the user. This mirrors the way flight-search engines or insurance aggregators operate today.

The key for designers is making the process feel simple, even if the underlying system is incredibly advanced.

Retailers and Platforms: The Silent Winners

Merchants love BNPL because it boosts conversion rates and average order value. With auction-based BNPL, they may see even greater benefits:

- higher approval rates,

- lower cart abandonment,

- faster payouts from lenders,

- and flexible integration options.

Marketplaces could even run their own credit auctions internally, turning financing into a profit center. Platforms that handle large transaction volumes — such as travel, electronics, or home improvement — stand to benefit the most.

The Road Ahead: What the Next Five Years May Bring

BNPL is not going away. It’s evolving, becoming smarter, more adaptive, and more embedded in everyday life. Auction dynamics will likely play a significant role in this transformation. We’re heading toward a world where consumers may no longer accept static loan terms — they’ll expect credit to compete for their attention, just like ads and promotions do.

This shift could make credit more human, more personalized, and more responsive to real-world conditions. But it will also demand a strong regulatory framework to ensure fairness, clarity, and consumer protection.

For now, the smartest thing businesses and consumers can do is stay aware, stay informed, and remain open to what flexible finance can become. Whether it’s dynamic auction pricing or the next breakthrough in credit technology, the future of borrowing is moving quickly — and everyone involved will need to adapt.